Impact investment for saving the climate

Invest your money sustainably today – without exploiting Nature or people! Our Generation Forests have long-term protection and will generate a green return for you.

Invest sustainably to tackle climate change

Investing in climate protection is necessary to ensure a sustainable future. At the same time, we need to stop financing activities that are harmful to the climate. One thing is clear: The financial sector is a key lever for climate protection. It is a matter of steering more funds toward having an environmentally-friendly future. Huge investments are needed to realise international climate targets. But this is not just about institutional investors, for you, as a private individual, can also make a significant contribution. By joining together, we can mobilise capital towards a transformation to a closed-loop economy.

Precious tropical timber as a sustainable investment

We are a dynamic, growing cooperative with an innovative forestry concept that combines climate protection with economic returns. Alongside green investments, our project also enables the conservation of species diversity conservation and creates jobs where they are urgently needed. And you, as a member, will benefit from our Generation Forests, as will future generations.

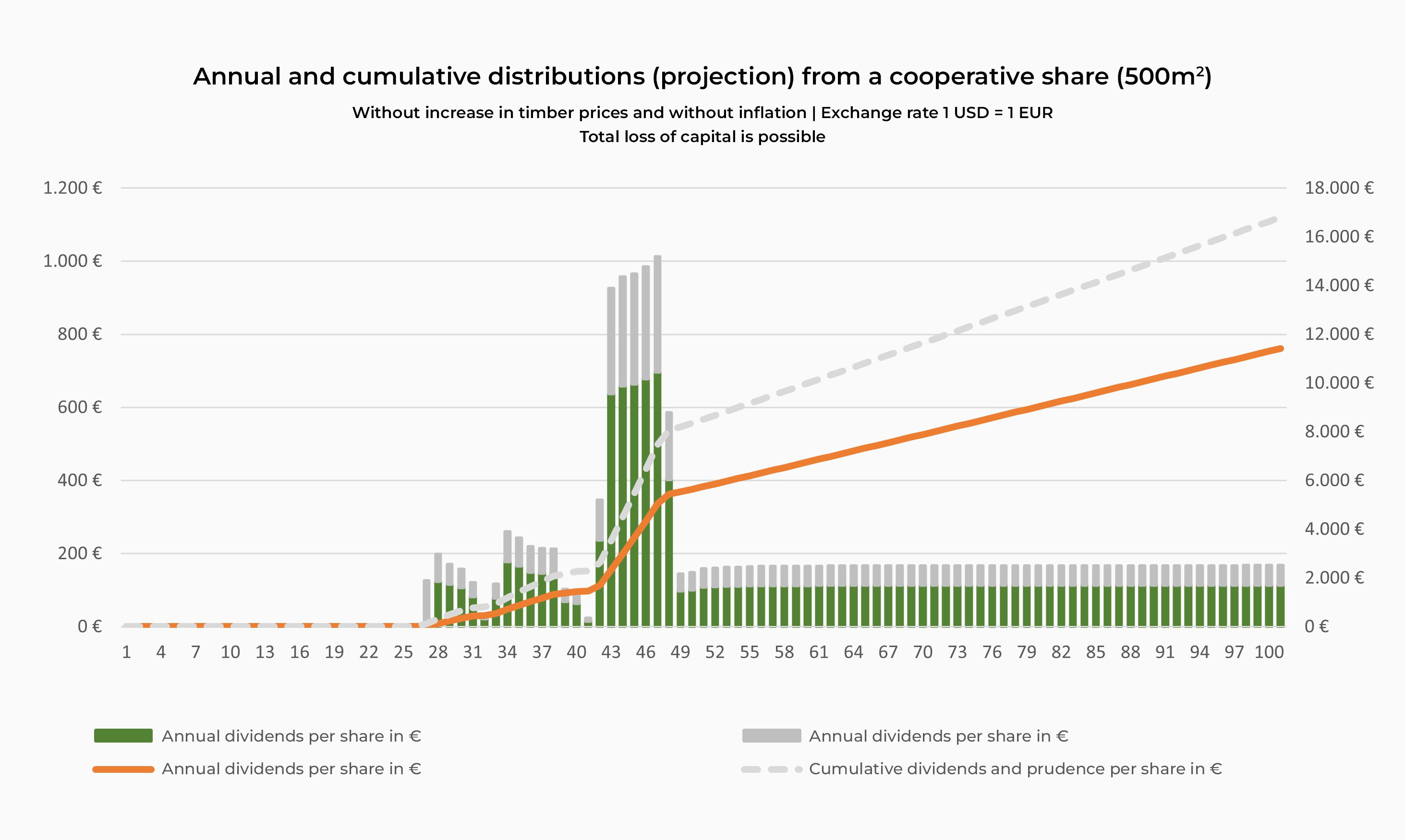

Unmoved by the ups and downs of the stock markets, our trees grow a bit more each day – and these are some of the most precious varieties of timber in the world. Our approach to sustainable investment is patient because the value grows as the trees grow. We rigorously shun all speculative assumptions such as rising prices for timber and land.

More Information

Here you will find a study on the economic viability of various timbers and the Generation Forest principle.

Green money through an investment opportunity that positively impacts the world. To that end, we plant and manage permanent forests that will consistently produce exotic timbers such as Mahogany and Spanish Cedar 100 years from now. Our business plan is devised long-term based on our forestry and financial planning. We are convinced of one thing: It is only through long-term thinking that we can make an essential contribution to the goal of sustainability.

How your money is used

As a social business, we are bound to pursue our mission. We operate on cost basis, and all profits go to our members. Of course, this includes rigorous transparency toward stakeholders and members. We happily share our financial models, operating figures, contracts, property deeds and other documents.

Forest

The largest part of the cooperative capital is used for the construction and maintenance of the forest: Preparation of the soil, planting and care of trees, and management of the forest.

This corresponds to 55 %.

Land

Our cooperative owns all the land used for our reforestation projects. This ensures that our forest will remain forever.

This corresponds to 20 %.

Cooperative

The cooperative uses one quarter for administration, reporting, quality control, auditing, and marketing.

This corresponds to 25 %.

The Generation Forests concept was developed by our co-founders, Iliana Armién and Andreas Eke, together with the Futuro Forestal team in Panama. The other parties involved included indigenous communities, research institutions, and the United Nations Environmental Programme (UNEP).

The Generation Forest is the realisation of the concept in the form of a cooperative. With Futuro Forestal as a vital partner, we can harness more than 30 years of experience:

![]()

The advantage of tropical trees is that they grow faster and absorb CO2, fetch better prices on the timber markets, and the afforestation process is easier compared to forests in Germany and Europe.

Our carefully selected portfolio of more than 20 different species of tree, especially domestic ones, offers a range of fast and slow-growing tree species. They form the core of our Generation Forests. Our sustainable tropical timber and our sustainable business practices have been awarded the FSC® stamp.

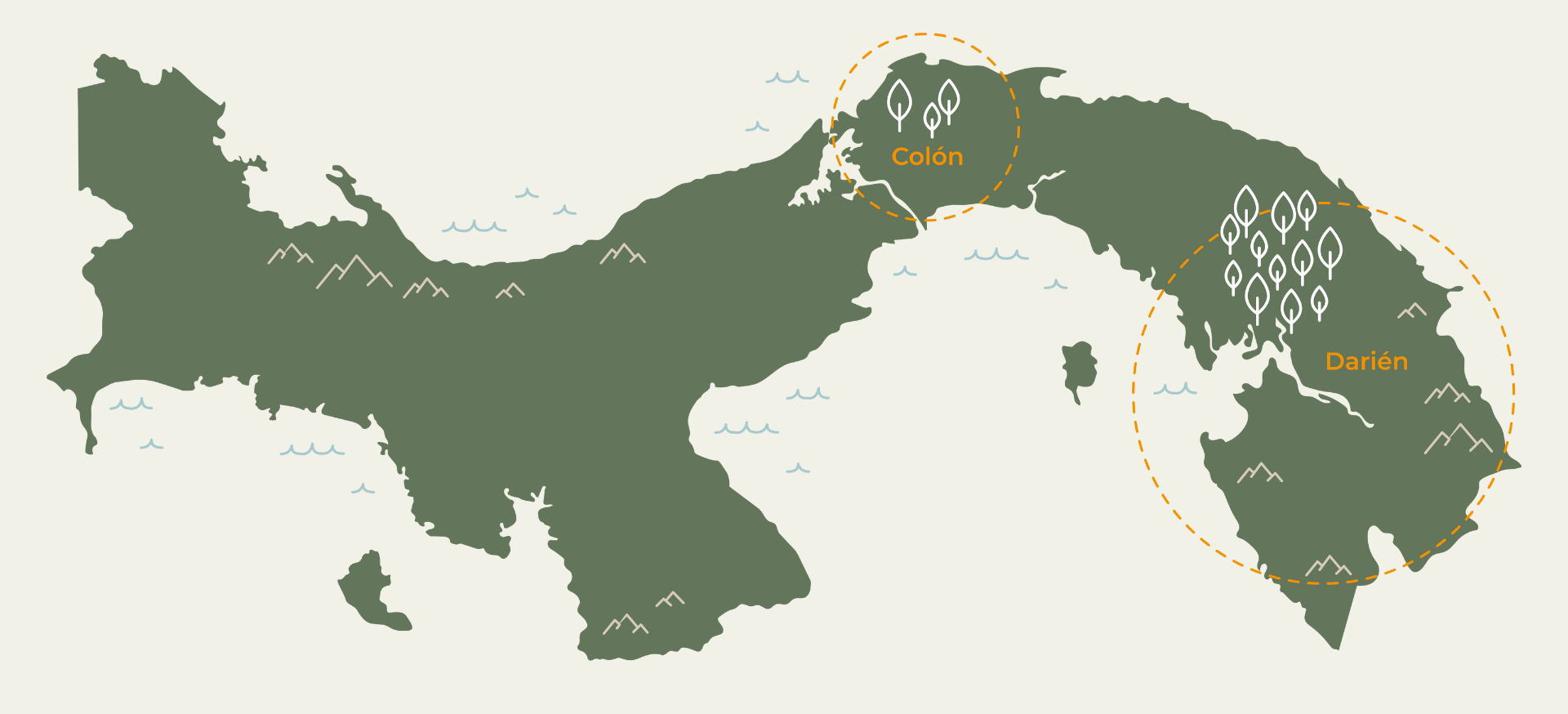

There are political, economic, logistical, and climatic reasons for our choice of location. Panama is a solid part of the international community, and offers reliable framework conditions. In contrast to temperate zones, forests grow quickly in the tropics. This gives our members a dual advantage: Making a greater impact in terms of environmental and climate protection, and the faster, more efficient growth of their investment.

We are an enterprise that is firmly rooted in Panama through our co-founders and partners. We cultivate good relations with a range of local stakeholders. For decades now, moreover, Panama has held a progressive political stance towards afforestation projects. It was this policy that saw the launch of the "Allianza por el millión" afforestation initiative. As a cooperative, we are the first non-Panamanian enterprise to join this initiative.

- Investment protection agreement between Germany and Panama

- US dollar as stable national currency

- Stable democracy with strategic importance for global trade

- Tax exemption for profits from afforestation projects

- Government bond ratings: Baa1 (Moodys), BBB+ (S&P)